First Steps

Our journey begins with an informal conversation. Be it over a phone call or a virtual meeting, we take this opportunity to understand you better — your aspirations, your financial health, and your concerns. As a young healthcare professional, we know that you are juggling a demanding career and personal commitments. And we’re here to guide you in making informed decisions about your financial future.

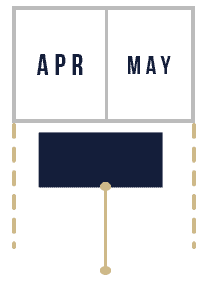

First Virtual Meeting (Chief Complaint)

Second Virtual Meeting (Diagnosis)

Third Virtual Meeting (Becoming a client)

Onboarding

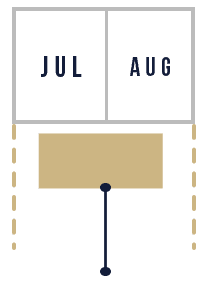

Getting Organized

Dream Meeting

Risk Meeting

Presentation Meeting

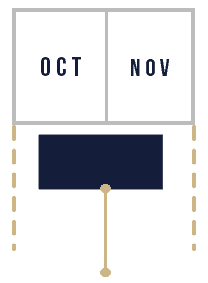

Dream Meeting

Presentation Meeting

Getting Organized

Risk Meeting

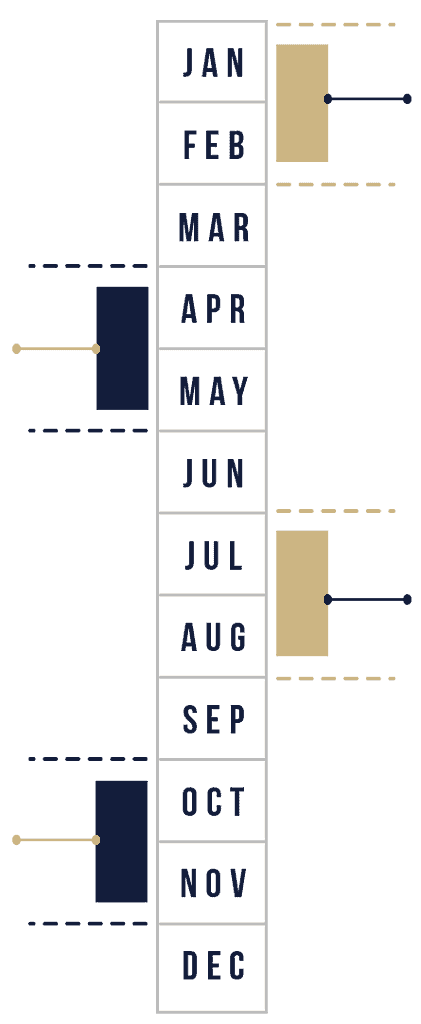

Quarterly Check-Ins

At Mainstay Capital, we believe that financial planning is an ongoing process. As your life evolves and your goals change, so should your financial plan. That’s why we offer regular reviews to ensure that your plan remains effective in helping you achieve your financial objectives.

If your schedule gets too crazy we can meet virtually from the convenience of your home or office. We also offer video recordings if you are unable to attend a check-in meeting. Our goal is to make the process as convenient and flexible as possible for our clients.

- Retirement Contributions

- HSA Contributions

- Investment Policy

- Upcoming Tax Forms

- Stock Option Exercise

- Account Distribution (Retirees)

- RMD / QCD (Retirees)

- Student Loans

- Life Insurance

- Beneficiaries / Estate Plan

- Social Security

- Review Tax Return

- Long Term Care (LTC)

- Disability Insurance

- Property Insurance

- Employee Benefits

- College Funding

- Tax Planning

- Roth Conversions

- Tax Loss/Gain Harvesting

- Open Enrollment (Medical)

- End-of-year RMD Check (Retirees)

- Student Loans

- Life Insurance

- Beneficiaries / Estate Plan

- Social Security

- Review Tax Return

- Tax Planning

- Roth Conversions

- Tax Loss/Gain Harvesting

- Open Enrollment (Medical)

- End-of-year RMD Check (Retirees)

- Retirement Contributions

- HSA Contributions

- Investment Policy

- Upcoming Tax Forms

- Stock Option Exercise

- Account Distribution (Retirees)

- RMD / QCD (Retirees)

- Long Term Care (LTC)

- Disability Insurance

- Property Insurance

- Employee Benefits

- College Funding

Our Process

What We Offer

- Emergency fund vehicle and level

- Budgeting

- Debt management and reduction strategies

- Cash flow projections

- Retirement plan contributions contributions (Trad. vs. Roth)

- Tax withholding optimization

- HSA contributions

- Home purchase decision

- College education planning

- Stock compensation elections (ISO, NSO, RSU, RSA)

- Social Security claiming strategies

- Income planning

- Tax planning in retirement

- Roth conversion strategies

- Retirement withdrawal planning

- Medicare planning

- Timing of retirement

- Pension election planning

- Required Minimum Distributions (RMDs)

- Qualified Charitable Distributions (QCDs)

- Asset class allocation

- Investment selection and monitoring

- Tax-efficient investing strategies

- Advice on retirement accounts

- Advice on annuities

- Identify taxable income and tax rate

- Tax-loss harvesting

- Tax-gain harvesting

- Tax diversification strategies

- Minimization of estate and gift taxes

- Tax-efficient charitable giving

- Plan cash flow for quarterly tax payments

- Tax planning for business owners

- Retirement account contributions

- Coordination with your CPA on annual tax filings

- Review tax returns for potential tax savings

- Review of existing documents (Will, Trust, Advanced Medical Directive, Power of Attorney, etc.)

- Beneficiary designations

- Charitable estate planning

- Estate settlement advice

- Legacy planning

- Gifting strategies

- Coordination with your estate attorney

- Life insurance analysis

- Long-term care insurance planning

- Disability insurance analysis

- Liability insurance analysis (Auto, home, umbrella)

- Insurance beneficiary designations

- Coordination with insurance agents for policy updates

- Health insurance analysis

- Estate planning for life insurance proceeds

- Asset allocation within cash balance plans

- In-force ledgers and illustration analysis

We offer specialized consulting services for young healthcare professionals, including guidance on tax planning, retirement planning, and insurance needs specific to the healthcare industry.

- 401k Setup: We can help you set up a 401k plan for your small business, taking into consideration factors such as employee demographics and contribution options.

- Employee Benefits: We can assist in designing an attractive and competitive benefits package for your employees, including health insurance, life insurance, and disability insurance.

- Business Valuation: We can provide guidance on valuing your business and developing a succession plan to ensure a smooth transition of ownership.

- Buy/Sell Agreements: We can help you create buy/sell agreements to protect your business in the event of an unexpected death or disability of one of the owners.

- Tax Strategies: We can help you navigate the complex tax landscape for small businesses and identify potential areas for tax savings.

- Risk Management: We can review your business operations and provide recommendations to minimize risk and protect your business from liability .

- Exit Planning: We can assist in developing an exit strategy for your business, ensuring that you have a plan in place for when you are ready to retire or sell the business.

- Financial Planning Fee: Our firm charges $2,400/yr for financial planning. This includes the full list of services we offer, as well as the first $200,000 of assets managed at no additional charge.

- Onboarding Fee: New clients pay a one-time onboarding fee of $1,200. This is to compensate the time for your advisor to build your financial plan and optimize your finances. We like to think of it this way: Including your financial planning fee, your first year will be $3,600, then $2,400 each year after.

- Asset Management Fee: The table below outlines our competitive asset management fees, which are in additional to financial planning fees.

| Assets Managed | Annual Fee |

|---|---|

| under $200,000.00 | INCLUDED (0.00%) |

| $200,000 to $1,000,000 | 0.30% |

| $1,000,000 to $5,000,000 | 0.20% |

| in excess of $5,000,000 | 0.10% |

Our goal is to make the cost of financial planning and wealth management clear and transparent. Financial Planning, Small Business Advising, and Asset Management fees are the ONLY revenue for our firm. We do not have any hidden fees, commissions, or kick-backs. This allows us to always act in the best interest of our clients.