The Ultimate Financial Blueprint for Young Healthcare Professionals

The Ultimate Financial Blueprint for Young Healthcare Professionals

Starting your career as a dentist or physician is exciting—but it also brings unique financial challenges. From juggling student loan payments and 1099 taxes to planning for retirement and someday owning a practice, there’s a lot to tackle. This guide offers a clear, step-by-step plan to help young healthcare professionals master their finances, build lasting security, and pursue practice ownership with confidence.

Key topics: tax planning for doctors, dentist student loan management, retirement planning for healthcare professionals, fiduciary financial advisor for doctors.

1. Understanding Your Financial Starting Point

Every strong financial plan begins with an honest look at where you stand today. Take time to gather your numbers and commit to tracking them regularly.

1.1 Budgeting and Cash Flow

• List all income sources (W-2 salary, 1099 contractor work, side gigs).

• Track monthly expenses: rent or mortgage, utilities, groceries, insurance, student-loan payments, practice expenses (if any).

• Aim for a simple zero-based budget—every dollar is assigned a purpose.

1.2 Student Loan Snapshot

Outline each loan: remaining balance, interest rate, repayment plan (e.g., income-driven repayment, public student loan forgiveness), and monthly payment. A clear picture helps you compare strategies like refinancing versus staying on an income-driven plan.

1.3 Tax Profile

If you’re a 1099 contractor or part owner of a practice, you must handle quarterly tax filings. Even if you’re W-2, additional income streams can complicate your tax picture. Starting early gives you more time to optimize deductions, retirement contributions, and potential entity structures.

2. Mastering Tax Planning for Doctors

Effective tax planning can save thousands annually. Here’s how to get started:

2.1 Quarterly Estimated Taxes

If you receive 1099 income or have side revenue, calculate your estimated tax payments each quarter. Tools like IRS Form 1040-ES worksheets or online calculators can help. Underpaying leads to penalties; overpaying ties up cash you could invest.

2.2 Business Entity Considerations

Operating as an S-corporation or LLC may offer tax benefits. Earnings distributed as dividends can avoid self-employment tax. Work with a qualified CPA or an fiduciary financial advisor for doctors to weigh the costs and complexity.

2.3 Maximizing Deductions

Retirement contributions (401(k), SEP IRA, SIMPLE IRA)—reduce taxable income.

Business expenses—home office, CME courses, professional dues, malpractice insurance.

Health savings account (HSA) contributions if you have a high-deductible health plan.

Keep thorough receipts and log business mileage automatically with an app.

3. Conquering Student Loan Management

Student debt can feel overwhelming. But with a tailored student loan management plan, you can reduce interest costs and gain peace of mind.

3.1 Income-Driven Repayment vs. Refinancing

Income-driven plans cap your payment based on your discretionary income—often 10%–15%. If you expect loan forgiveness (Public Service Loan Forgiveness or 20-year forgiveness), staying on that track makes sense. If you have solid cash flow, refinancing at a lower interest rate could save money but forfeits federal protections.

3.2 Forgiveness Programs

Public Service Loan Forgiveness (PSLF)—available after 120 qualifying payments for government or nonprofit employers.

State-specific programs—some states offer loan repayment assistance for practice in underserved areas.

20 years of payments on an Income Driven Repayment program may result in forgiveness of the remaining loan balance.

3.3 Prepayment Strategies

If you aim to pay off debt aggressively, apply extra payments to the principal on the highest-rate loans first. Automate an additional fixed amount monthly to reduce your balance faster.

4. Building a Solid Retirement Plan

Even early-career physicians and dentists should prioritize retirement planning. Time is your greatest ally when compounding growth is on your side.

4.1 Retirement Account Options

401(k) or 403(b) through your employer—max out any matching contributions first.

Individual Retirement Accounts (Traditional IRA or Roth IRA)—consider Roth if you expect higher tax rates later.

SEP IRA or Solo 401(k) if you have side income or run a small practice.

4.2 Asset Allocation Basics

Young professionals can afford a growth-oriented mix, then gradually shift toward more conservative allocations as you near practice ownership or retirement.

4.3 Catch-Up Contributions

Once you turn 50, you can make catch-up contributions in addition to the annual limit. Plan ahead so you’re ready to boost savings when the time comes.

5. Planning for Practice Ownership

Owning your own dental or medical practice can be rewarding—but it requires careful financial and operational planning.

5.1 When to Consider Ownership

• You have stable cash flow and a solid credit history.

• You understand local market demand and have a clear business plan.

• You’re prepared for upfront costs: real estate, equipment, staffing.

5.2 Financing Your Practice

Bank loans or SBA loans—competitive rates but strict underwriting.

Seller financing—may require higher interest but fewer upfront costs.

Partner buy-ins—pool resources with colleagues to lower individual debt.

5.3 Practice Management Consulting

Expert guidance can streamline billing, staffing, and compliance. Explore our Our Process page to see how we help healthcare clients launch and grow practices.

6. Risk Management and Insurance

Protecting your income and loved ones is a vital part of your financial blueprint.

6.1 Term Life Insurance

Term policies offer high coverage at low cost. As your income grows, you can layer on additional policies to match evolving needs.

6.2 Disability Insurance

A top-priority for physicians and dentists—covering 50%–60% of your gross income if illness or injury prevents you from working.

6.3 Malpractice and Liability

Ensure you have adequate malpractice coverage, especially if you’re transitioning to private practice ownership. Umbrella liability policies can provide an extra layer of protection.

7. Why Choose a Fiduciary Advisor?

Working with a fiduciary financial advisor ensures your interests come first. Here’s what to expect when you partner with us:

Transparent Fees: $1,200 onboarding + $2,400/year. Asset management is free under $200K, 0.3% over $200K.

Comprehensive Services: Quarterly check-ins, on-call support, detailed analyses of taxes, student loans, investments, and insurance.

Structured Process: Four onboarding meetings covering organization, goals, risk management, and customized recommendations.

Ethical Standards: As a CFP®, MBA, and IRS Enrolled Agent, we follow strict standards of conduct and avoid conflicts of interest.

Disclaimer: This information is educational only and does not constitute personalized advice. Past performance does not guarantee future results.

8. Creating Your Personalized Financial Blueprint

Pulling it all together, your financial blueprint should include:

A clear budget and cash-flow plan updated monthly.

Quarterly tax payment schedule with entity-structure reviews.

Student loan strategy aligned with your career path.

Retirement account setup and target asset allocation.

Insurance coverage to protect income and family.

Timeline and criteria for practice-ownership decisions.

9. Next Steps

You don’t have to navigate your financial journey alone. Schedule a free discovery call today to explore how we can help you build and execute your personalized financial plan.

Schedule Your Call

Questions? Contact us directly at marcus.miller@mainstay-capital.com or call 813-699-9317.

© 2025 Mainstay Capital. All rights reserved. Disclaimer: This content is for educational purposes only. Please consult a qualified financial professional before making any decisions.

Smart Year-End Tax Strategies and Professional Development Tips for Early-Career Physicians and Dentists

Your Year-End Tax & Career Growth Guide

As a physician or dentist, your days are dedicated to patient care, leaving little time to diagnose your own financial health. Yet, the strategic decisions you make before year-end can profoundly impact your wealth, career, and long-term security. This guide provides a clear, actionable plan to optimize your finances, turning year-end obligations into powerful opportunities.

The High Stakes of December 31st: Why Proactive Planning is Non-Negotiable

For medical professionals, a high income often comes with a complex tax situation. Failing to plan is like leaving money on the table—money that could be compounding in your retirement accounts or funding your next career move. By acting before the deadline, you can:

Slash your taxable income through strategic retirement and health savings contributions.

Unlock deductions unique to your practice, from equipment to continuing education.

Build long-term wealth by aligning your tax strategy with your investment goals.

Let’s move from diagnosis to treatment with a checklist of essential financial maneuvers.

Your Essential Year-End Financial Checklist

1. Supercharge Your Tax-Advantaged Accounts

This is your most powerful tool for reducing your current tax bill while building future wealth.

Workplace Retirement Plan (401(k), 403(b)): Aim to contribute the maximum amount. For 2025, the projected limit is $23,500 (plus a $7,500 catch-up contribution if you’re over 50).

Private Practice Plans (SEP IRA, Solo 401(k)): If you’re self-employed or have independent income, these plans offer much higher contribution limits—potentially up to $69,000 for 2025.

Health Savings Account (HSA): The ultimate triple-threat vehicle. Contributions are tax-deductible, growth is tax-free, and qualified medical withdrawals are tax-free. For 2025, projected limits are $4,300 for an individual and $8,550 for a family.

2. Leverage Your Practice and Professional Deductions

Your career-related expenses are a rich source of potential tax savings. Ensure you’ve meticulously tracked:

Equipment and Supplies: Any clinical tools or office supplies purchased this year.

Professional Fees: Don’t forget state licensing fees, board certifications, and memberships to organizations like the AMA, ADA, or specialty societies.

Continuing Education: The cost of courses, seminars, travel, and professional journals are valuable deductions (more on this below).

Home Office: If you have a dedicated space for administrative work, you may qualify for the home office deduction.

Beyond Tax Deductions: Building Your Wealth Engine

While tax savings are an immediate reward, the true power of your contributions is realized over decades of tax-deferred or tax-free compounding. A dollar invested in your 30s can easily be worth ten times as much as a dollar invested in your 50s.

Embrace Diversification: A healthy financial portfolio includes a mix of pre-tax (401(k)), tax-free (Roth IRA, HSA), and taxable brokerage accounts. This gives you flexibility in retirement.

Consider a Backdoor Roth IRA: If your income is too high for direct Roth IRA contributions, this strategy allows you to get funds into a Roth account, securing tax-free growth for life.

Automate and Rebalance: Set your investment strategy based on your risk tolerance and goals, and review it annually to ensure it remains aligned with your objectives.

Learn how we tailor investment strategies for medical professionals on our Our Process page.

Investing in Your Greatest Asset: You

Continuing Medical or Dental Education (CME/CDE) is a requirement, but it’s also a strategic investment. The right courses not only fulfill licensing needs but can also boost your income, improve practice efficiency, and open new career pathways.

Maximize Deductibility: Meticulously document all related expenses, including course fees, travel, lodging, and materials.

Choose for ROI: Prioritize education that adds a new profitable service (like implantology or advanced diagnostics), improves practice management, or develops leadership skills.

Leverage Allowances: If employed, use your employer’s CE allowance first. If in private practice, create a dedicated budget for professional development early in the year.

Your 90-Day Sprint to the Finish Line: Next Steps Before December 31st

Diagnose Your Financials:

Review your year-to-date income and project your total earnings to estimate your 2025 tax bracket.

Prescribe Your Contributions:

Schedule the final contributions to max out your 401(k), IRA, and HSA accounts.

Compile Your Dossier:

Gather and catalog all receipts for business, professional, and educational expenses by mid-December.

Consult Your Team:

Meet with your CPA or financial advisor armed with your data to finalize your strategy.

Plan for 2026:

Map out your professional development goals for next year, balancing required credits with high-impact growth opportunities.

Our Services can help you implement this plan seamlessly. We partner with physicians and dentists to create tax-efficient financial plans that power their careers.

Frequently Asked Questions

Q: What’s the latest I can make contributions for the 2025 tax year?

A: While 401(k) contributions must be made by December 31, 2025, you generally have until the tax filing deadline (typically April 15, 2026) to fund your IRA and HSA for the 2025 tax year.

Q: Are virtual conferences just as deductible as in-person ones?

A: Absolutely. The registration fees and costs for any required materials are fully deductible. If you have a dedicated home office, a portion of your utilities and internet during the conference may also qualify.

Q: My income is high. Can I still benefit from an IRA?

A: Yes. While you may not be able to deduct contributions to a Traditional IRA, you can still make non-deductible contributions and potentially convert them to a Roth IRA via the “Backdoor Roth IRA” strategy. This is a powerful tool for high-income earners.

Conclusion: Take Control of Your Financial Future

Mastering your finances is a critical component of a successful and sustainable medical career. By treating your financial planning with the same diligence you apply to patient care, you can minimize your tax burden, accelerate wealth creation, and build a life of financial independence. These year-end strategies are your prescription for a healthier financial future.

Ready to build a comprehensive financial plan? Visit our About Us page to see how MainStay Capital, a registered investment adviser, empowers healthcare professionals to achieve their goals.

Disclaimer: This content is for informational purposes only as of September 2025 and is not intended as personalized investment, legal, or tax advice. Tax laws are subject to change. Please consult a qualified tax advisor and financial professional before making any decisions. Past performance is not indicative of future results.

7 Financial Strategies for Early-Career Healthcare Professionals

7 Financial Strategies for Early-Career Healthcare Professionals

Embarking on a medical or dental career is an exciting milestone, but the financial landscape you inherit can feel complex. From managing student loans to planning for private practice growth, early-career physicians and dentists face unique challenges. At Mainstay Capital, we’ve guided healthcare professionals through these critical years. In this comprehensive guide, you’ll discover seven practical strategies—rooted in real-world experience—to align your vision, stabilize cash flow, and set a sustainable path for long-term success.

1. Clarify Your Vision and Core Values

Before diving into spreadsheets or investment products, take a moment for self-reflection. What motivates you? Family stability, community impact, early retirement, or philanthropic goals might top your list. Aligning financial planning with your personal and professional values ensures every decision supports your larger mission.

Why Values-Driven Planning Matters

Provides clear direction for budgeting, saving, and investing.

Helps set realistic expectations for practice ownership or partnership.

Minimizes decision fatigue when facing unexpected financial challenges.

Action Steps

Host a vision-setting session: Write down your top five personal and professional objectives.

Rank values by urgency: Consider what matters most in the next 1, 5, and 10 years.

Document a preliminary “Financial Mission Statement” to guide all future plans.

2. Build a Robust Cash Flow and Budget Plan

Effective cash flow management is the bedrock of financial stability for early-career healthcare professionals. Whether you’re earning your first attending salary or billing patients in private practice, understanding inflows and outflows will empower smarter decisions.

Key Components of a Healthcare Professional Budget

Fixed Expenses: Rent or mortgage, insurance premiums, loan payments.

Variable Expenses: Continuing education, medical equipment, travel.

Deferred Goals: Emergency fund accumulation, retirement contributions.

Tools and Techniques

Adopt specialized budgeting software tailored to physicians and dentists.

Schedule a quarterly “finance check-in” to adjust projections after seasonality or practice growth.

Automate savings: Allocate a portion of every deposit to emergency reserves and retirement accounts.

For an in-depth walkthrough of our cash flow process, visit our Our Process page.

Compliance note: All recommendations are illustrative. Your results may vary based on individual circumstances. Past performance does not guarantee future returns.

3. Tackle Student Loans and Debt Strategically

Medical and dental school debts often eclipse six figures. While income-driven repayment or refinancing can offer relief, a tailored strategy will minimize total interest and help you reach financial independence sooner.

Debt-Reduction Strategies

Evaluate Repayment Options: Public Service Loan Forgiveness, income-driven plans, hybrid strategies.

Refinancing Considerations: Look for competitive rates, flexible terms, and potential tax deductions.

Snowball vs. Avalanche: Choose a payoff method that aligns with your psychological and financial goals.

Professional Tax Planning

Maximize above-the-line deductions for student loan interest.

Structure your professional entity—LLC or S-corp—for optimal tax efficiency.

Plan charitable giving and retirement contributions to reduce taxable income.

Your debt payoff timeline should sync with personal goals—starting a family, purchasing a home, or opening a practice. For guidance on entity structuring and tax-smart strategies, explore our Services.

Compliance note: Mainstay Capital does not provide legal advice. Consult a professional advisor before implementing legal strategies.

4. Finance Your Private Practice or Partnership Entry

Transitioning from employee to practice owner or equity partner brings both freedom and financial risk. Structured planning around financing, overhead, and growth milestones is essential to avoid cash crunches.

Financing Options

Conventional Bank Loans: Industry-specific lenders often offer favorable terms for healthcare professionals.

Equipment Leasing: Preserve capital by leasing high-cost diagnostic or dental equipment.

Physician-Specific Programs: Investigate association-based loan forgiveness or low-interest credit lines.

Controlling Overhead and Scalability

Leverage technology to automate patient billing and appointment scheduling.

Adopt a lean staffing model early; cross-train staff to handle multiple functions.

Implement scalable workflows that allow adding providers without exponential cost increases.

For a blueprint on practice financing and scalable infrastructure, learn more via our Services offerings.

Compliance note: Investment strategies involve risk. There is no guarantee that any investment or strategy will be suitable or profitable.

5. Plan for Sustainable Growth and Succession

As your practice matures, shifting responsibilities to associates or partners becomes vital. Thoughtful succession planning ensures client continuity and preserves the firm’s legacy.

Developing Your Team

Create clear career pathways and compensation models for emerging providers.

Implement regular performance reviews and a structured feedback loop.

Offer mentorship programs to transfer client relationships smoothly.

Succession Roadmap

Draft a multi-phase transition timeline: from first referral handoff to full autonomy.

Establish governance policies and decision-making protocols.

Handle equity transitions with clear valuation metrics and buy-sell agreements.

Curious about our approach? Visit the About Us page to see our team’s background in guiding practice transitions.

6. Balance Personal Milestones with Financial Goals

Your life outside the clinic—family, health, hobbies—should thrive alongside your financial plan. Overcommitment can erode both your well-being and your bottom line.

Integrating Personal and Professional Plans

Create a “life calendar” marking events like weddings, children, or sabbaticals.

Allocate savings and insurance coverage—disability, life, health—to protect loved ones.

Set aside time and budget for self-care and continuing education.

Wellness and Financial Therapy

Consider financial coaching or therapy to align mindset and money behaviors.

Track non-financial metrics—sleep, exercise, stress levels—to optimize performance.

Reassess your vision periodically to avoid burnout and maintain fulfillment.

7. Next Steps: Build Your Customized Financial Roadmap

Implementing these seven strategies will position you for sustained success—both financially and personally. Whether you’re an attending physician, a newly minted dentist, or a practice partner, our team at Mainstay Capital is ready to guide you every step of the way. Visit our Our Process page to schedule a complimentary discovery call and begin crafting a plan tailored to your unique goals.

Thank you for trusting us as your fiduciary partner. We look forward to supporting your journey from early-career ambitions to enduring freedom and impact.

© 2025 Mainstay Capital. All Rights Reserved. Mainstay Capital is a Registered Investment Advisor. Advisory services are offered only to clients or prospective clients where Mainstay Capital and its representatives are properly licensed or exempt from licensing.

Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. This blog post is for informational purposes and does not constitute an offer to sell or a solicitation of an offer to buy any security.

Maximizing Your 401(k) Contributions as a Healthcare Professional Approaching Year-End

Maximizing Your 401(k) Contributions as a Healthcare Professional Approaching Year-End

As a busy physician, dentist, or healthcare practitioner, you dedicate countless hours to patient care—and often, planning your personal finances takes a back seat. Yet optimizing your retirement savings before year-end can have a profound impact on your long-term wealth and tax position. This comprehensive guide will walk you through each step of assessing your 401(k) contributions, calculating the precise payroll deduction needed, and avoiding costly over-contribution errors. By acting now, you can position yourself to reach the annual contribution limit, leverage tax benefits, and stay on track for a comfortable retirement.

1. Understand Your 401(k) Contribution Limits for 2025

Each year, the IRS sets maximum limits on elective deferrals to workplace retirement plans. For 2025, the individual 401(k) contribution limit is $23,500. If you’re age 50 or older, you can make an additional catch-up contribution of $7,500, bringing your total possible deferral to $31,000.

Under Age 50: $23,500 maximum deferral.

Age 50+ Catch-Up: Additional $7,500 permitted.

Physicians and dentists often see fluctuating paychecks due to bonuses, locum tenens contracts, or varying on-call schedules. That makes it critical to track year-to-date contributions and adjust mid-year if necessary.

2. Assess Your Year-to-Date Contributions

Before October rolls around, log in to your 401(k) portal or review recent pay stubs to determine how much you’ve already contributed. For example, if you’ve contributed $10,000 by September 30, you have $13,500 remaining toward the $23,500 limit.

Steps to follow:

Access your online retirement account or payroll portal.

Sum your deferrals through your most recent paycheck.

Note the remaining allowance (limit minus year-to-date contributions).

Having this figure in hand allows you to calculate exactly how much to direct from each paycheck in the final quarter.

3. Calculating Your Required Paycheck Deferrals

Once you know the remaining balance, determine how many paychecks you expect between November 1 and December 31. If you receive biweekly pay, that’s typically four paychecks. Dividing the remaining allowance by four gives the dollar amount you need to defer each period.

Example Calculation

You have $13,500 left to contribute and expect four paychecks:

$13,500 ÷ 4 = $3,375 needed per paycheck.

Most plans require you to enter a percentage of your gross pay rather than a dollar amount. To find that, divide the per-check target by your gross pay. If your gross is $14,000 per paycheck:

$3,375 ÷ $14,000 = 0.241 (24.1%).

Round to the nearest whole or half percent as allowed by your plan (e.g., 24%).

4. Navigating Employer Plan Rules and Deadlines

Different employers impose various processing windows for contribution changes. Some require notice at least two pay periods before the effective date. To avoid surprises:

Contact HR or your plan administrator by mid-October.

Confirm the effective date for your new deferral election.

Submit the required paperwork or portal entries promptly.

If the effective date is later than November 1, reduce the number of paychecks used in your calculation accordingly.

5. Strategies to Avoid Over-Contribution

Overstepping the annual limit triggers complex corrections and may create unexpected tax bills. Consider these precautions:

Conservative Buffer: Aim for slightly under the limit (e.g., leave $100–$200 unused) to account for payroll timing variances.

Regular Check-Ins: Monitor your contributions after each pay period.

Plan for Catch-Up: If you’re 50+, track your catch-up contributions separately.

By building in a small cushion, you reduce the risk of excess deferrals that require reclassification and potential taxable income.

6. Fine-Tuning Your Investment Allocation

Maxing out your contributions is only half the battle—allocating those dollars effectively is equally important. As a healthcare professional, your schedule may make frequent rebalancing difficult. Consider these principles:

Diversification: Spread contributions across equity funds, bond funds, and stable value options.

Risk Tolerance: Younger physicians may favor a higher equity tilt; dentists approaching retirement may prefer conservative allocations.

Lifecycle Funds: Target-date funds offer automatic rebalancing aligned with your expected retirement year.

Review your fund lineup on an annual basis and adjust as your practice income, family situation, or risk tolerance evolves.

7. Tax Implications and Benefits

Every dollar you defer pre-tax reduces your current taxable income. For a high-earning physician in the 32% federal bracket, deferring $23,500 could lower federal taxes by $7,520, plus state tax savings where applicable.

Additional advantages:

Tax-Deferred Growth: Investments compound without current tax drag.

Potential Employer Match: If you start contributing more now, you’ll capture any matching contributions your employer offers on deferrals up to a cap.

Consult your tax advisor to understand how increased deferrals interact with other year-end planning, such as charitable giving or estimated tax payments.

8. Common Pitfalls and How to Avoid Them

Even experienced clinicians occasionally run into issues when making late-year contribution adjustments:

Missed Effective Dates: Submitting elections late can push your change into January of the following year.

Incorrect Percentage: Rounding errors may leave you underfunded or create an excess.

Overlooking Catch-Up: Failing to designate age-50+ contributions correctly.

Minimize mistakes with a step-by-step checklist and periodic reviews.

9. How Mainstay Capital Can Support You

At Mainstay Capital, we specialize in helping busy healthcare professionals optimize their retirement strategies. Our holistic approach covers:

Our Process: Personalized planning tailored to your career stage and risk profile.

Services: From tax-efficient savings strategies to portfolio management.

About Us: Meet the team of CFP® professionals who understand the unique financial challenges of physicians and dentists.

Ready to take control of your retirement savings? Schedule a complimentary consultation today.

Disclaimer: This blog post is for informational purposes only and does not constitute personalized financial advice. Mainstay Capital is a Registered Investment Advisor. Always consult your tax advisor or financial professional before making changes to your retirement plan contributions.

Maximizing Real Estate Returns: A Practical Guide for Physicians, Doctors, and Dentists

Maximizing Real Estate Returns: A Practical Guide for Physicians, Doctors, and Dentists

As a busy healthcare professional, you’re accustomed to precision, evidence-based decisions, and tangible outcomes. When it comes to real estate investing—whether you’re exploring rental property valuation, understanding IRR in real estate for physicians, or considering a multifamily acquisition—those same principles should guide your strategy. This guide walks you through a proven framework that uses real, current financial data to help you negotiate better deals and work toward your target Internal Rate of Return (IRR).

Why Relying on Pro Forma Can Be Risky

In marketing materials, sellers often present a “pro forma” forecast showing optimistic rents, low vacancy rates, and high appreciation. While these projections can look compelling, they’re built on assumptions rather than actual performance.

Common Pro Forma Pitfalls

Inflated Rent Assumptions: Marketing brochures may list market rents significantly above what current tenants pay.

Unrealistic Vacancy Rates: A 3–5% vacancy rate can be overly optimistic compared to market averages of 8–12%.

Deferred Maintenance Blind Spots: Hidden capital expenditure needs that reduce net cash flow.

For doctors and dentists accustomed to data-driven diagnoses, these gaps can feel like unchecked variables in your investment’s prognosis.

Step 1: Base Your Analysis on Actual Financial Performance

Start by requesting the seller’s most recent income and expense statements, rent rolls, and tax returns. This “as-is” data reveals true cash flow and vacancy patterns.

Key Data Points to Collect

Rent Roll: Actual rents paid per unit versus advertised market rents.

Vacancy History: Month-by-month vacancy statistics for the past 12–24 months.

Operational Expenses: Maintenance, utilities, management fees, insurance, and real estate taxes.

With real data in hand, you build a model that reflects the property’s current health—not a best-case marketing projection.

Step 2: Calculate Your Realistic IRR

Your target IRR (often in the 12–18% range for physicians exploring rental properties) should be grounded in numbers you control:

Purchase Price

Actual Net Operating Income (NOI)

Projected Growth Rate (e.g., 3–5% annual rent growth)

Exit Cap Rate (market-based exit yield)

By plugging these inputs into a discounted cash flow model, you’ll see whether the deal fits your return objectives—without surprises.

Step 3: Use a Tiered Offer Strategy

Instead of a single, take-it-or-leave-it bid, structure your negotiation around four tiers:

Great Deal: Purchase price that meets or exceeds your high-end IRR target.

Good Deal: A slightly higher price that delivers a solid but more moderate IRR.

Average Deal: A middle-ground price offering below-target returns but still acceptable.

Walk-Away Price: Maximum price at which IRR falls below your comfort zone.

This framework ensures you remain disciplined and don’t overpay when emotions run high.

Step 4: Incorporate a “Reality Check” Clause

When submitting an offer, include a contingency that allows you to back out or renegotiate if the due diligence data deviates materially from what was presented. Typical “reality check” triggers include:

Variance in vacancy rates exceeding 5% from the seller’s statements

Unreported deferred maintenance costs

Rent roll discrepancies greater than 10%

This clause protects you from unforeseen twists and aligns the seller’s projections with actual performance.

Step 5: Plan Your Capital Deployment

Healthcare professionals often have substantial capital—consider:

Down Payment (typically 20–25%)

Closing Costs (~2–4% of purchase price)

Initial Repairs and Reserves (1–3% of value)

Factor these into your model to ensure you understand total cash required and can evaluate leverage ratios responsibly.

Case Study Snapshot

Imagine a 10-unit property marketed at $1.8 million. The seller’s pro forma shows a 5% vacancy and $1,650/unit rent, projecting an IRR of 17%. However, a deep dive into actual rents ($1,030/unit) and an 11% vacancy rate reveals a sub-10% IRR. By negotiating down to $1.0 million, you might secure a 14% IRR—closer to your goals—and mitigate downside risk.

This reflects real-world scenarios our clients—physicians, dentists, and medical entrepreneurs—face when evaluating multifamily deals.

Bringing It All Together: Our Process

At Mainstay Capital, we guide busy healthcare professionals through every stage of real estate investing. From initial property screening to negotiating offers and managing due diligence, our step-by-step approach keeps your objectives front and center.

Explore Our Process

Learn About Our Services

For an in-depth discussion, visit our About Us page or schedule a complimentary consultation.

Next Steps for Healthcare Investors

Gather actual financial statements on potential properties.

Run your own IRR analysis using conservative inputs.

Develop a tiered offer strategy aligned with your goals.

Include due diligence contingencies to verify key assumptions.

Allocate capital reserves for closing costs and initial repairs.

By following these practical steps, you position yourself for smarter negotiations and sustainable returns in the competitive real estate market.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Past performance is not indicative of future results. Consult with a qualified financial advisor before making any investment decisions.

Tax-Savvy Real Estate Investing

Tax-Savvy Real Estate Investing for Physicians: Mastering Depreciation, Basis Adjustments & Casualty Losses

As a busy physician, dentist, or healthcare professional, balancing patient care with personal wealth building can feel like a juggling act. Real estate investment offers an attractive avenue for long-term growth, passive income, and portfolio diversification. Yet, effective tax management—specifically understanding rental property depreciation, basis adjustments, and casualty loss deductions—can be complex.

In this guide, we’ll walk through the critical strategies every medical professional should know to maximize tax benefits on your rental properties, from accurate basis tracking and depreciation schedules to handling insurance proceeds after damage or loss. We’ll also cover compliance tips, record-keeping best practices, and when to enlist professional support.

Why Physicians Should Consider Rental Real Estate

Before diving into detailed tax topics, let’s briefly highlight why rental properties can be an ideal complement to a medical career:

Passive Income Stream

Rental cash flow can supplement your income without trading additional hours in clinic.

Appreciation Potential

Over time, property values tend to rise—feeding your equity and net worth.

Tax Benefits

Depreciation, deductible expenses, and strategic basis adjustments can lower your effective tax rate.

Diversification

Real estate often behaves differently than stocks or bonds, reducing overall portfolio volatility.

Ready to leverage these advantages? Start with a solid tax plan tailored to your unique circumstances. Below, we tackle the three pillars of rental property taxation for healthcare professionals.

1. Tracking & Adjusting Your Property Basis

Basis is the cornerstone of property-tax calculations. It represents your investment in an asset for tax purposes. Properly tracking—and, when appropriate, adjusting—basis affects:

Depreciation deductions

Casualty loss calculations

Gain or loss upon sale

What Goes Into Your Initial Basis?

Your initial basis generally equals the purchase price plus acquisition costs:

Purchase price of the property

Closing costs (e.g., legal fees, title search)

Improvements made prior to placing in service

Example: You purchase a small single-family rental home for $250,000. Closing costs total $5,000. Your initial basis is $255,000.

Increasing Basis: Capital Improvements

Any improvements that add value or extend the life of the property must be added to the basis. Common examples:

New roof, HVAC system, or plumbing upgrades

Deck addition, kitchen remodel, added windows

Physicians often DIY projects to save costs—good for cash flow, but be sure to keep meticulous records. Receipts, invoices, bank statements, or even texts confirming payment can substantiate these capital expenditures if audited.

Reducing Basis: Deductions & Dispositions

Your basis also decreases when you:

Take depreciation deductions

Receive insurance reimbursements for capital items eliminated by casualty (e.g., total loss)

Sell part of the property interest

Staying on top of these adjustments ensures you don’t understate gains or inadvertently over‐deduct losses.

2. Maximizing Depreciation Deductions

Depreciation allows you to write off a portion of the property’s value over its useful life, reducing taxable rental income one year at a time.

Residential Rental Property Depreciation Basics

Recovery Period: 27.5 years (straight-line method)

Placed in Service: May be a full or partial year depending on PBS (Property Becomes Serviceable).

Component Depreciation: Separate out land improvements (e.g., driveway, landscaping) on a 15-year schedule.

Case Study: Asphalt Driveway Depreciation

Dr. Patel acquired a farm property in 2021 with a newly paved driveway for $6,600. Although the main building depreciates over 27.5 years, the asphalt driveway is a 15-year asset.

Asphalt basis: $6,600

Annual depreciation: $6,600 ÷ 15 ≈ $440/year

Ensure your depreciation schedule reflects this asset separately—not buried in the building value.

Documentation & Software Tips

Most tax software will generate a detailed depreciation schedule, but healthcare professionals often use H&R Block or QuickBooks for rentals. If you don’t see a separate line item for driveway or land improvements:

Manually adjust the basis in the software

Upload or attach invoices in your vault or client portal

Confirm the depreciation schedule aligns with IRS Publication 527 guidelines

3. S-Corp & Partnership Basis Tracking (When Applicable)

If you hold properties through an S-Corporation or partnership, you need to track your shareholder or partner basis. Why? Because basis determines:

How much loss you can deduct personally

Distribution limits without triggering taxable gain

Gain or loss upon sale of the interest

Form 7203 & Basis Computation

Beginning in 2020, every S-Corp shareholder must complete Form 7203 to prove basis. Even if your tax software didn’t auto-generate it, the IRS expects the calculation.

Key Steps:

Start with your initial capital contribution

Add share of income, additional investments

Subtract distributions and share of losses/depreciation

Missing or overstating basis can lead to disallowed losses—effectively paying more tax.

4. Compliance & Best Practices

As a Registered Investment Advisor (RIA) firm under SEC and state rules, we must avoid any promise of specific outcomes or personalized tax advice without knowing your full situation. This post is for educational purposes only. Always confirm strategies with a qualified tax professional.

Avoid guaranteeing refunds or tax savings.

Use disclaimers: “Consult your tax advisor.”

Maintain client confidentiality; never share personal numbers or returns in marketing materials.

Learn More About Our Process & Services

At Mainstay Capital, we specialize in working with busy physicians, dentists, and healthcare professionals to build tax-efficient investment portfolios. Learn how we guide you from analysis to execution:

Our Process

Services Overview

About Us

Tax-Savvy Real Estate Investing for Physicians: Mastering Depreciation, Basis Adjustments & Casualty Losses

As a busy physician, dentist, or healthcare professional, balancing patient care with personal wealth building can feel like a juggling act. Real estate investment offers an attractive avenue for long-term growth, passive income, and portfolio diversification. Yet, effective tax management—specifically understanding rental property depreciation, basis adjustments, and casualty loss deductions—can be complex.

In this guide, we’ll walk through the critical strategies every medical professional should know to maximize tax benefits on your rental properties, from accurate basis tracking and depreciation schedules to handling insurance proceeds after damage or loss. We’ll also cover compliance tips, record-keeping best practices, and when to enlist professional support.

Why Physicians Should Consider Rental Real Estate

Before diving into detailed tax topics, let’s briefly highlight why rental properties can be an ideal complement to a medical career:

- Passive Income Stream

Rental cash flow can supplement your income without trading additional hours in clinic. - Appreciation Potential

Over time, property values tend to rise—feeding your equity and net worth. - Tax Benefits

Depreciation, deductible expenses, and strategic basis adjustments can lower your effective tax rate. - Diversification

Real estate often behaves differently than stocks or bonds, reducing overall portfolio volatility.

Ready to leverage these advantages? Start with a solid tax plan tailored to your unique circumstances. Below, we tackle the three pillars of rental property taxation for healthcare professionals.

1. Tracking & Adjusting Your Property Basis

Basis is the cornerstone of property-tax calculations. It represents your investment in an asset for tax purposes. Properly tracking—and, when appropriate, adjusting—basis affects:

- Depreciation deductions

- Casualty loss calculations

- Gain or loss upon sale

What Goes Into Your Initial Basis?

Your initial basis generally equals the purchase price plus acquisition costs:

- Purchase price of the property

- Closing costs (e.g., legal fees, title search)

- Improvements made prior to placing in service

Example: You purchase a small single-family rental home for $250,000. Closing costs total $5,000. Your initial basis is $255,000.

Increasing Basis: Capital Improvements

Any improvements that add value or extend the life of the property must be added to the basis. Common examples:

- New roof, HVAC system, or plumbing upgrades

- Deck addition, kitchen remodel, added windows

Physicians often DIY projects to save costs—good for cash flow, but be sure to keep meticulous records. Receipts, invoices, bank statements, or even texts confirming payment can substantiate these capital expenditures if audited.

Reducing Basis: Deductions & Dispositions

Your basis also decreases when you:

- Take depreciation deductions

- Receive insurance reimbursements for capital items eliminated by casualty (e.g., total loss)

- Sell part of the property interest

Staying on top of these adjustments ensures you don’t understate gains or inadvertently over‐deduct losses.

2. Maximizing Depreciation Deductions

Depreciation allows you to write off a portion of the property’s value over its useful life, reducing taxable rental income one year at a time.

Residential Rental Property Depreciation Basics

- Recovery Period: 27.5 years (straight-line method)

- Placed in Service: May be a full or partial year depending on PBS (Property Becomes Serviceable).

- Component Depreciation: Separate out land improvements (e.g., driveway, landscaping) on a 15-year schedule.

Case Study: Asphalt Driveway Depreciation

Dr. Patel acquired a farm property in 2021 with a newly paved driveway for $6,600. Although the main building depreciates over 27.5 years, the asphalt driveway is a 15-year asset.

- Asphalt basis: $6,600

- Annual depreciation: $6,600 ÷ 15 ≈ $440/year

- Ensure your depreciation schedule reflects this asset separately—not buried in the building value.

Documentation & Software Tips

Most tax software will generate a detailed depreciation schedule, but healthcare professionals often use H&R Block or QuickBooks for rentals. If you don’t see a separate line item for driveway or land improvements:

- Manually adjust the basis in the software

- Upload or attach invoices in your vault or client portal

- Confirm the depreciation schedule aligns with IRS Publication 527 guidelines

3. Handling Casualty Losses & Insurance Proceeds

When a rental property suffers damage—fire, flood, windstorm, or other qualifying casualty—you may deduct the unreimbursed loss on your federal return.

Calculating Your Casualty Loss

The basic formula under current law:

Casualty Loss = Adjusted Basis of Damaged Property

− Insurance Reimbursement

− Insurance Deductible (if not covered)

Example: Your building basis (your 2/3 share): $87,935. Insurance payout: $33,950. Loss = $87,935 − $33,950 = $53,985. This deduction flows to Schedule E, reducing your rental income.

Confirming Basis & Transcripts

If you’re unsure whether that asphalt paving was added to basis or if depreciation began correctly, you’ll want your prior returns. Two main routes:

- Request free tax return transcripts via IRS.gov

- Grant your advisor power-of-attorney (Form 8821 or 2848) to fetch transcripts on your behalf

Transcripts confirm that your $6,600 cost was capitalized and that depreciation schedules reflect your ownership percentage.

Reporting on Schedule E

All casualty losses pass through Schedule E (Supplemental Income and Loss). Losses offset rental income dollar for dollar. If losses exceed income, a net loss flows to Schedule 1 of Form 1040.

4. S-Corp & Partnership Basis Tracking (When Applicable)

If you hold properties through an S-Corporation or partnership, you need to track your shareholder or partner basis. Why? Because basis determines:

- How much loss you can deduct personally

- Distribution limits without triggering taxable gain

- Gain or loss upon sale of the interest

Form 7203 & Basis Computation

Beginning in 2020, every S-Corp shareholder must complete Form 7203 to prove basis. Even if your tax software didn’t auto-generate it, the IRS expects the calculation.

Key Steps:

- Start with your initial capital contribution

- Add share of income, additional investments

- Subtract distributions and share of losses/depreciation

Missing or overstating basis can lead to disallowed losses—effectively paying more tax.

5. Utility & Occupancy Tax Record-Keeping

Payments for utilities and short-term rental occupancy taxes (e.g., via Avalara) are fully deductible as expenses against rental income.

Staying Organized

- Maintain a master spreadsheet (e.g., “JEA for Rentals 2024”) broken down by property

- Reconcile checking transactions for any cloud-based payments or third-party platforms

- Request monthly or annual reports from occupancy-tax software (Avalara, Hostfully, etc.)

Even subscription fees (e.g., $27–$28/month) are ordinary business expenses.

6. Pre-Sale Repairs & Basis Bumps

Preparing a property for sale often involves maintenance and capital projects. These can further adjust your basis, ultimately lowering your taxable gain.

What Qualifies?

- Professional services (e.g., painting labor: $1,800)

- Materials (flooring, trim, mailbox replacements)

- Minor renovations done by owner—document fair-market labor value if audited

Note: Routine landscaping or cleaning does not qualify as basis additions.

Clawback on Depreciation

When you sell, any depreciation you’ve claimed must be “recaptured” and taxed at up to 25%. While adding last-minute repairs can slightly boost basis, it won’t erase the recapture requirement.

Example: Dr. Chen’s team spent $2,500 prepping a vacation rental for sale. Painting and materials increase her basis by $2,500. She still reports depreciation recapture on Schedule D/Form 4797.

7. Compliance & Best Practices

As a Registered Investment Advisor (RIA) firm under SEC and state rules, we must avoid any promise of specific outcomes or personalized tax advice without knowing your full situation. This post is for educational purposes only. Always confirm strategies with a qualified tax professional.

- Avoid guaranteeing refunds or tax savings.

- Use disclaimers: “Consult your tax advisor.”

- Maintain client confidentiality; never share personal numbers or returns in marketing materials.

Next Steps for the Busy Healthcare Professional

Here’s your quick action plan:

- Gather prior year returns or IRS transcripts

• Confirm pavement, improvements, and depreciation schedules. - Reconstruct S-Corp/Partnership Basis (Form 7203)

• Track capital contributions, distributions, losses. - Compile utility & tax software reports

• Organize by property in a centralized spreadsheet. - Document pre-sale repairs & invoices

• Add receipts to your digital vault for basis adjustments. - Schedule a tax strategy review

• Book time with our team via Schedule a Call.

With these steps, you’ll be well-positioned to minimize taxable income, maximize allowable deductions, and streamline your next property sale.

Learn More About Our Process & Services

At Mainstay Capital, we specialize in working with busy physicians, dentists, and healthcare professionals to build tax-efficient investment portfolios. Learn how we guide you from analysis to execution:

Maximizing Tax-Free Retirement: Roth 401(k) vs. Roth IRA for Young Healthcare Professionals

Maximizing Tax-Free Retirement: Roth 401(k) vs. Roth IRA for Young Healthcare Professionals

As a physician, dentist, or other young healthcare professional, you’ve invested years training to help others. Yet in the whirlwind of residency, patient care, and study, it’s easy to overlook one of the most powerful wealth-building tools available: Roth retirement accounts. This guide walks you through the key differences between Roth 401(k) vs. Roth IRA, highlighting why time-tax-and compound-interest advantages can supercharge your long-term financial security. We’ll also explore advanced benefits—like ERISA creditor protection, loan provisions, and contribution thresholds—that make a Roth 401(k) an intriguing option for high-earning physicians and dentists.

Whether you’re a resident thinking ahead or an attending physician planning early retirement, understanding the nuances of tax-free retirement savings for doctors and dentists will empower you to make confident choices. By the end of this article, you’ll have a clear picture of which Roth vehicle aligns with your goals—and how to implement it seamlessly into your financial strategy.

1. Why Roth Accounts Matter for Young Healthcare Professionals

Young healthcare workers often face a unique financial journey: years of low-pay training followed by a significant jump in income upon board certification. During residency and fellowship, you may be in a lower tax bracket—an ideal window to fund a Roth account. Once fully licensed, you’ll likely move into higher tax brackets. By front-loading Roth contributions while your current marginal rate is lower, you lock in tax-free growth and withdrawals forever.

Key Advantages of Roth Accounts

Tax-Free Growth: Earnings and qualified withdrawals are not taxed in retirement.

No Required Minimum Distributions (RMDs): Roth IRAs never mandate distributions. As of 2025, Roth 401(k)s also avoid lifetime RMDs, offering maximum flexibility in retirement planning.

Compound Interest: Money that grows tax-free compounding year after year creates a larger nest egg compared to taxable accounts.

Estate Planning Benefits: With no RMDs, you can pass Roth IRAs (or inherited Roth 401(k) assets after plan rollover) to heirs tax-free.

For doctors and dentists early in their careers, the ability to maximize contributions while in a lower tax bracket—and then withdraw those funds tax-free decades later—can create an exponential growth curve. This makes Roth accounts a cornerstone of physician retirement planning.

2. Roth IRA vs. Roth 401(k): Core Features Compared

Both Roth IRAs and Roth 401(k)s offer tax-free growth, but they differ in several critical areas. Understanding these distinctions will help you decide which account (or combination) best suits your needs as a high-earning healthcare professional.

Contribution Limits & Eligibility

Roth IRA: For 2025, contribution limit is $7,000 (plus $1,000 catch-up if age 50+). Contributions phase out for modified adjusted gross income (MAGI) above $150,000 for single filers and $236,000 for married couples filing jointly.

Roth 401(k): Contribution limit is $23,500 for 2025 (plus $7,500 catch-up if age 50+). No MAGI phase-out applies. Highly compensated employees may face plan-level testing, but there’s no universal federal income cap.

Creditor Protection

Under ERISA (Employee Retirement Income Security Act), employer-sponsored retirement plans—including Roth 401(k)s—benefit from robust federal-level creditor protection. This can be particularly valuable for physicians and dentists in high-liability fields. Roth IRAs receive variable protection under state law, which may be less predictable.

Loan Provisions

Many Roth 401(k) plans allow participants to borrow against vested contributions (typically up to 50% of your balance, capped at $50,000). Roth IRAs prohibit loans. For early-stage professionals who may need liquidity—whether to buy a home or cover unexpected expenses—the loan feature can provide a cushion without tapping taxable or penalty-prone sources.

Employer Matches and Vesting

Roth 401(k): Employer matches are common in group practices or hospital plans. Though matching funds go into a pre-tax account, it’s a valuable bonus.

Roth IRA: No employer match exists.

3. Strategic Considerations for Physicians and Dentists

Choosing between a Roth IRA and Roth 401(k) isn’t necessarily an either/or decision. Many physicians adopt a hybrid approach, optimizing each vehicle’s strengths to accelerate their tax-free retirement savings for doctors.

Early-Career: Maximize Tax Arbitrage

While in residency or fellowship (lower bracket), contribute to a Roth IRA for upfront tax-free growth.

If your hospital or group practice offers a match, contribute to the Roth 401(k) up to the match threshold—capturing “free money.”

Mid-Career: Income Rises, But So Do Limits

As income climbs, you may exceed Roth IRA MAGI limits. Shift excess savings into the Roth 401(k) for continued Roth contributions.

Consider a backdoor Roth IRA if you still want to fund an IRA beyond the Roth 401(k) plan.

Late-Career: Fine-Tuning Withdrawals

With both accounts in place—and no RMDs on Roth IRAs or Roth 401(k)s —you have flexibility to manage taxable income in early retirement. Withdraw from taxable and tax-deferred sources strategically, leaving Roth assets intact to cover future expenses or pass on to heirs tax-free.

4. Implementation Steps: From Selection to Contribution

Putting theory into practice requires an organized approach. Here’s a step-by-step roadmap for young healthcare professionals to launch or optimize Roth contributions.

Assess Your Employer Plan: Check if your hospital or practice offers a Roth 401(k). Review match policies, loan options, and vesting schedules.

Open/Roll Over a Roth IRA: If you don’t have an IRA, open one at a low-cost custodian. Consider rolling any existing Traditional IRA to a Roth IRA via conversion if it aligns with your tax strategy.

Set Up Automatic Contributions: Automate payroll deferrals to the Roth 401(k) and ACH transfers to the Roth IRA. Consistent contributions harness dollar-cost averaging.

Max Out Employer Match: Prioritize contributions up to your employer match on the Roth 401(k) before funding other accounts.

Fund Both Accounts Strategically: Balance Roth IRA contributions (while under MAGI limits) with excess savings funneled into the Roth 401(k).

Review Annually: Revisit contribution amounts, income phase-out thresholds, and plan features each year—especially after major life events like board exams, practice buy-ins, or salary increases.

For personalized guidance on implementation, explore our Process or learn more about our tailored Services for healthcare professionals.

5. Common FAQs for Young Healthcare Professionals

Q1: Can I contribute to both a Roth IRA and a Roth 401(k) in the same year?

Yes—as long as you don’t exceed each account’s limit and your income permits Roth IRA contributions. You can contribute up to $7,000 to a Roth IRA (plus catch-up) and up to $23,500 to a Roth 401(k) for 2025 (plus catch-up), independently.

Q2: What if my income exceeds Roth IRA limits?

You can still fund a Roth 401(k) without income triggers. Alternatively, consider a Backdoor Roth IRA strategy—making non-deductible Traditional IRA contributions and converting to Roth.

Q3: How do Roth 401(k) RMD rule changes affect me?

Roth 401(k)s are exempt from required minimum distributions, matching Roth IRA rules. This preserves your ability to let assets grow tax-free indefinitely.

Q4: Are there risks with Roth contributions?

The primary risk is higher current taxation. You pay taxes upfront, so if your tax bracket in retirement is lower, you might “over-pay” on taxes. However, most young physicians expect higher future earnings, making Roth contributions attractive.

6. Compliance and Best Practices

This content is provided for educational purposes only and does not constitute individualized investment advice. Mainstay Capital, LLC is a registered investment adviser. For personalized advice that considers your unique circumstances, please consult a qualified tax professional or financial advisor.

All rules regarding contribution limits, income thresholds, and plan provisions are subject to change. Verify current IRS guidelines or contact your plan administrator annually.

7. Take the Next Step Toward Lasting Financial Security

Young healthcare professionals hold unique growth and tax planning opportunities. By strategically leveraging Roth accounts for young healthcare professionals, you can accelerate tax-free retirement wealth and enjoy peace of mind in your golden years. Ready to build a customized plan that aligns with your career trajectory and personal goals?

Visit our About Us page to learn more about our experience with physicians and dentists, or contact our team to schedule a complimentary consultation.

How Cyborg Financial Advisors Are Transforming Wealth Management for Young Healthcare Professionals

How “Cyborg” Financial Advisors Are Transforming Wealth Management for Young Healthcare Professionals

As a physician, dentist, or allied health professional starting your career, you juggle demanding schedules, ongoing education, and the responsibility of patient care. Amidst this whirlwind, planning your financial future can feel overwhelming. Enter the “cyborg” financial advisor: a hybrid approach that combines advanced AI-powered tools with human empathy and judgment. In this post, we’ll explore how this model can help you optimize cash flow, manage student loan debt, and build long-term wealth—without sacrificing the personalized touch you value.

By understanding the intersection of AI in financial planning and traditional advisory services, you’ll see how automated projections, stress-tested scenarios, and real-time insights can integrate seamlessly with a trusted advisor’s guidance. Let’s dive in.

1. The Rise of AI in Financial Planning

Financial technology (fintech) has evolved rapidly over the last decade. Tools once limited to large institutions are now accessible to individual advisors and their clients. Among these innovations, digital wealth solutions and predictive analytics stand out by providing:

- Automated cash-flow projections that model income fluctuations, expenses, and savings targets.

- Scenario stress tests that simulate market downturns, inflation changes, and life events like buying a home or starting a family.

- Real-time portfolio monitoring that flags rebalancing opportunities and potential tax-saving maneuvers.

Why AI Alone Isn’t Enough

While AI excels at number crunching and pattern recognition, it can’t fully grasp the psycho-emotional factors guiding your decisions. For instance, your risk tolerance isn’t merely a percentage—it’s shaped by experiences, values, and personal goals. A purely algorithmic plan might miss nuances such as:

- Your desire to reduce student loan debt quickly versus funding retirement.

- Emotional comfort with market volatility.

- The legacy you wish to leave for family or charitable causes.

This is precisely why the cyborg advisor model is gaining ground: it leverages AI’s computational power while preserving human empathy and strategic judgment.

2. Why Young Healthcare Professionals Need Holistic Financial Advice

Medical school tuition, residency stipends, and licensing fees add up quickly. Many young physicians and dentists graduate with substantial debt while also tackling high living expenses. A holistic approach considers:

- Debt management strategies to prioritize high-interest loans or explore refinancing options.

- Income optimization through tax-efficient structures, practice ownership, or side services.

- Insurance planning to protect against disability, liability, and malpractice claims.

- Retirement roadmaps that align contributions to IRAs, 401(k)s, or 403(b)s based on your career stage.

- Personal goals such as homeownership, family planning, or philanthropy.

Integrating AI tools within this framework lets advisors generate customized projections in minutes—rather than days—so you can see the impact of each decision immediately. But it also requires a trusted human partner to interpret these projections in light of your unique circumstances.

Ready to explore a holistic financial strategy? Learn more about Our Process to see how we combine technology with personalized guidance.

3. Understanding the Cyborg Advisor Model

The term “cyborg advisor” evokes a seamless synergy between machine intelligence and human insight. Here’s how it works in practice:

- Data Integration: Your advisor gathers financial data—bank accounts, loans, insurance policies—into a central planning platform. Automated AI note-taking captures meeting highlights and action items.

- Predictive Modeling: AI algorithms generate multiple “what-if” scenarios, from aggressive debt repayment to maximum retirement savings. These projections update in real time as assumptions change.

- Interactive Review: In a collaborative session, you and your advisor evaluate the scenarios. Your advisor asks structured questions to surface hidden values and adjust assumptions.

- Empathy-Driven Coaching: Your advisor translates technical outputs into relatable insights. Whether you’re anxious about market dips or unsure about practice ownership, they provide context and reassurance.

- Ongoing Monitoring: AI tools continuously scan for tax-saving opportunities, portfolio rebalancing triggers, and changes in your financial profile. Your advisor reviews critical alerts and recommends adjustments.

This approach offers the best of both worlds: the speed and accuracy of machine calculations plus the compassion and expertise of a dedicated professional. For young healthcare workers building their careers, this can be a game-changer.

4. Integrating AI Tools for Physicians, Doctors, and Dentists

Not all AI solutions are created equal. Here’s a look at the key categories and how they benefit healthcare professionals:

1. Financial Planning Software

Platforms like robust wealth management suites generate detailed cash-flow analyses and retirement projections. They allow advisors to:

- Run complex Monte Carlo simulations in seconds.

- Visualize retirement readiness with intuitive charts.

- Model practice buy-in or partnership transitions.

2. AI-Powered CRMs

Client Relationship Management systems with AI note-takers and meeting transcriptions streamline communication:

- Automatic follow-up reminders for key deadlines.

- Sentiment analysis to gauge client satisfaction.

- Data tagging for personalized outreach campaigns.

3. Middleware AI Assistants

These “behind-the-scenes” tools connect disparate systems—bank accounts, billing software, investment platforms—and feed unified data into planning dashboards.

Among these, financial planning software often takes center stage by delivering the most accurate projections. However, only a skilled advisor can interpret those results in light of your psycho-emotional drivers.

Interested in a technology-enhanced advisory experience? Discover our full Services tailored to healthcare professionals.

5. Steps to Build Your Personalized Financial Plan

Whether you’re fresh out of residency or a few years into practice, follow these five key steps:

- Clarify Your Goals: Do you plan to purchase a home, start a family, or launch a specialty practice? Document short- and long-term objectives.

- Consolidate Data: Aggregate your loan statements, investment accounts, insurance policies, and monthly budget.

- Leverage AI Projections: Use planning software to simulate different strategies—aggressive debt payoff, maxing retirement contributions, or diversifying investments.

- Align With Your Values: Partner with an advisor to interpret results and ensure the plan reflects your comfort level and broader life mission.

- Implement and Monitor: Automate savings, tax-loss harvesting, and portfolio rebalancing. Schedule quarterly check-ins to review AI-driven alerts and adjust as needed.

Curious about how we guide young professionals through this process? Learn more on our About Us page, then schedule a complimentary discovery call from our Homepage.

6. Overcoming Common Financial Challenges in Healthcare

Healthcare professionals often face unique obstacles: high debt loads, irregular income early in practice, and exposure to liability risks. Here’s how the cyborg advisor model addresses them:

- Student Loan Management: AI can rank loans by interest rate, suggest refinancing, or propose alternative repayment plans. Your advisor then compares pros and cons based on your career trajectory.

- Variable Income Smoothing: Predictive analytics forecast cash-flow gaps during fellowship or partnership buy-in. Automated budgeting tools keep you on track even when earnings fluctuate.

- Risk Mitigation: Machine learning flags potential shortfalls in disability or malpractice coverage. Your advisor works with insurance specialists to close any gaps.

- Tax Efficiency: AI-driven tax-planning modules identify deductions unique to medical professionals—continuing education, licensing fees, or home office expenses.

By pairing these AI insights with human expertise, you gain a comprehensive defense against financial stressors that can derail long-term wealth building.

Conclusion: Embracing the Future of Healthcare Wealth Management

The “cyborg” financial advisor model isn’t science fiction—it’s the next frontier in wealth management for young healthcare professionals. By blending AI’s predictive horsepower with the empathy and strategic vision of a human advisor, you get a financial plan that’s accurate, adaptive, and deeply personalized.

If you’re ready to experience this powerful synergy, visit MainStay Capital today. Our team specializes in financial planning for physicians, dentists, and allied healthcare professionals. Let us help you take control of your financial future—so you can focus on what you do best: caring for patients.

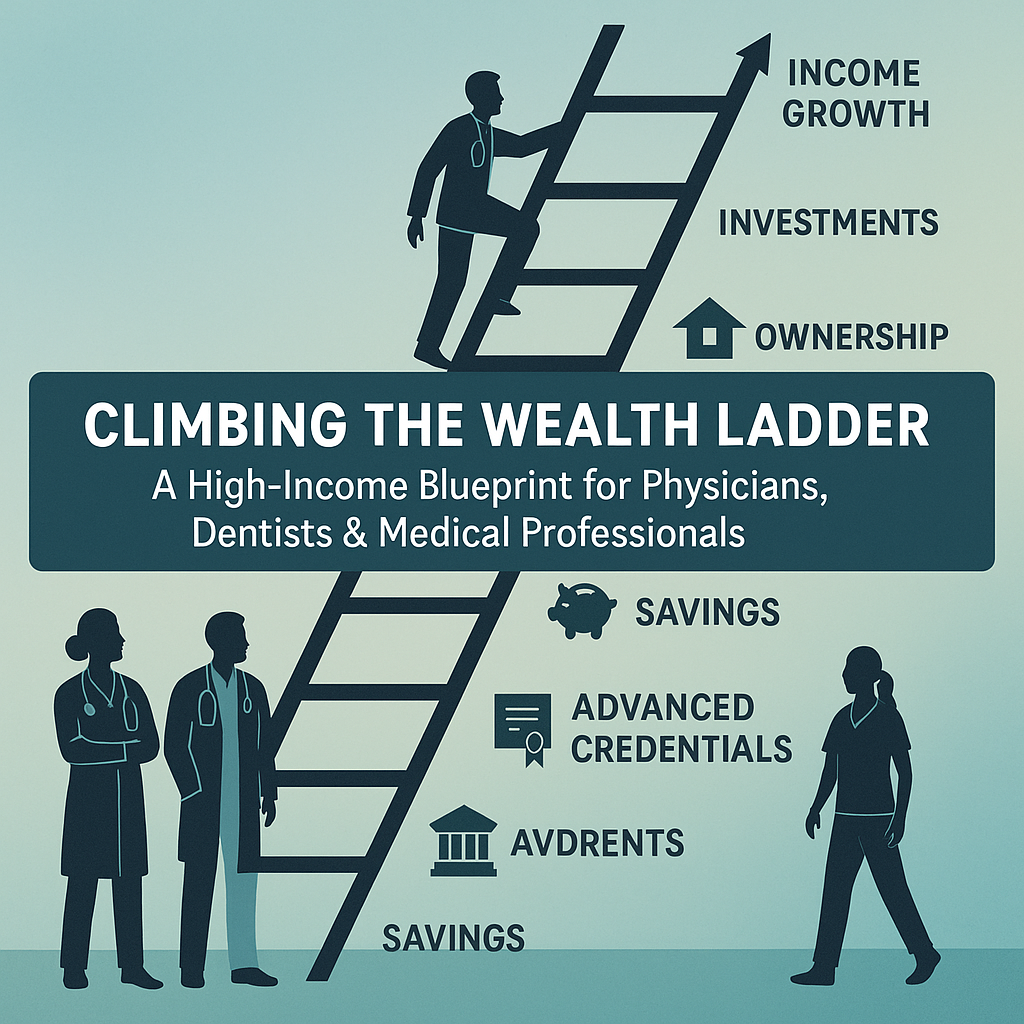

Climbing the Wealth Ladder: A High-Income Blueprint for Physicians, Dentists & Medical Professionals

Climbing the Wealth Ladder: A High-Income Blueprint for Physicians, Dentists & Medical Professionals

As a busy physician, dentist, or clinician, you’ve invested years honing your technical skills, earning degrees, and caring for patients. Yet when it comes to money, the path to building enduring wealth can feel uncertain. Does higher income automatically translate into a comfortable retirement? Which strategies move the needle fastest? In this comprehensive guide—tailored for medical professionals like you—we unpack why income today is the best leading indicator of wealth tomorrow, explore four high-impact income-growth paths, and lay out an actionable plan to climb your personalized “Wealth Ladder.”

Why Income Matters More Than You Think

Conventional personal finance advice often emphasizes budgets, spending discipline, and “mindset.” While important, empirical research shows that for working-age households, current income is the strongest predictor of future net worth. Data from long-running studies (such as the Panel Study of Income Dynamics) demonstrate:

Households in the top quintile of income in a given decade move to the top wealth quintile a decade later over 70% of the time.

High-income earners rarely end up with low net worth, provided they avoid extreme spending or leverage risks.

Conversely, modest incomes make it statistically harder to accumulate substantial assets, even with disciplined saving.

For medical professionals who often command above-average salaries, the opportunity is clear: focus on income growth to accelerate wealth creation, rather than relying solely on expense cutting or financial “mindset” shifts.

The Four Paths to Higher Income

Drawing on both academic findings and real-world case studies, experts identify four core ways to boost earnings:

Sales & Persuasion

In the medical context, sales skills translate to effective patient communication, negotiation of fee schedules, and physician leadership roles that come with performance-linked compensation.

Negotiating higher reimbursement rates with insurers or hospital systems

Leading high-value service lines (e.g., orthopedic sports medicine, cosmetic dentistry)

Developing referral networks and building specialty clinics

Technical & Analytical Expertise

Your clinical proficiency—whether robotic surgery, implant dentistry, or interventional radiology—is a high-value skillset that remains in demand despite automation trends. Consider sub-specialty fellowships or certifications that command premium billing codes.

Advanced Degrees & Credentials

Data shows that additional credentials—MBA, MPH, JD, or advanced clinical fellowships—can yield significant income boosts over time:

An MBA may unlock health system leadership roles or private equity opportunities in healthcare.

Joint MD/MBA programs often lead to executive director or C-suite positions.

Board certifications in high-margin specialties increase negotiating power.

Ownership Stakes

Equity ownership—whether in a private medical practice, dental clinic, or healthcare startup—offers exponential upside:

Partner shares in a group practice can yield distributions beyond salary.

Stock options in medical device or digital health firms align your clinical expertise with startup growth.

Franchise or multi-location dental models multiply earnings and resale value.

The “Wealth Ladder” Framework: From Income to Assets

The concept of a “Wealth Ladder” illustrates how you convert higher earnings into lasting net worth. Climbing each rung requires disciplined allocation of surplus income:

Save & Build Reserves: Maintain 6–12 months of expenses in liquid form—emergency fund and operating reserves for private practices.

Optimize Tax Efficiency: Max out retirement vehicles (401(k), 403(b), SEP-IRA) and leverage Section 179 for equipment depreciation.

Invest in Core Portfolios: Diversify across low-cost equities, bonds, and real estate investment trusts (REITs).

Expand Ownership: Reinvest practice profits into new service lines or physical expansions.

Legacy Planning: Implement trusts, buy-sell agreements, and insurance strategies to protect family wealth.

Every additional dollar of income can be deliberately directed up these rungs to multiply your long-term net worth.

Actionable Steps to Boost Your Income

Inventory Your Skills: Chart your clinical competencies, leadership abilities, and market demand gaps.

Set Income Targets: Define a 3- to 5-year earnings goal aligned with your desired net worth outcome (e.g., $500K base + $150K bonuses).

Develop a Credentials Roadmap: Plan fellowships, board certifications, or advanced degrees with clear ROI projections.

Negotiate Smart: Use benchmark data (MGMA, ADA surveys) when renegotiating compensation or partnership terms.

Explore Ownership: Evaluate practice valuations, partnership models, and potential startup co-founder roles.

Automate Savings: Schedule monthly transfers into tax-advantaged retirement, HSA, and brokerage accounts.

Review & Adjust Quarterly: Track income growth, net worth progression, and pivot as needed.

Integrating with Mainstay Capital

At Mainstay Capital, we partner with ambitious healthcare professionals to turn high income into enduring wealth. Our four-step process ensures your path is tailored, efficient, and compliant with fiduciary best practices:

Our Process: Strategy discovery, customized planning, implementation, and ongoing monitoring.

Services: Wealth planning, retirement strategies, tax optimization, risk management, and practice succession.

About Us: Meet our CFP® professionals and investment specialists dedicated to healthcare clients.

Ready to translate your hard-earned income into lifelong wealth? Contact us to schedule a complimentary discovery session.

Frequently Asked Questions

1. Why can’t I just save more and stop worrying about income?

While frugal habits help, data shows that savings rates alone cannot overcome low or stagnant earnings over decades. Expanding your income floor broadens the base from which you save and invest.

2. What if I’m already burdened with medical school debt?

High-interest loans can erode your ability to build wealth. Consider refinance strategies, income-driven repayment while you ramp up earnings, and accelerated payment plans once you hit new salary milestones.

3. How do I balance work–life with extra credentialing?

Frame credentialing as an investment. A carefully chosen fellowship or MBA program can pay for itself within 3–5 years via higher compensation and leadership roles.

Key Takeaways

Current income is the strongest leading indicator of future wealth for working professionals.

Focus on at least one of the four high-impact income paths: sales & persuasion, technical expertise, advanced credentials, or ownership stakes.

Allocate surplus income up the Wealth Ladder: reserves, tax-efficient retirement, diversified investments, and practice growth.

Review progress quarterly and adjust your strategy to stay on track toward your net worth goals.

Partner with fiduciary advisors who understand the unique needs of physicians, dentists, and healthcare leaders.

Disclosure & Compliance